|

Getting your Trinity Audio player ready...

|

By Agabaidu Chukwuemeka Jideani

As Nigeria marks the second anniversary of President Bola Ahmed Tinubu’s administration on May 29, 2025, the Abuja Chamber of Commerce and Industry (ACCI) offers an assessment of the government’s policies and their impact on businesses and economic growth.

Anchored on the “Renewed Hope” agenda, the administration has pursued ambitious reforms with positive intentions to address structural inefficiencies, boost private sector growth, and position Nigeria as a competitive economy. However, these policies have produced mixed results, with notable achievements tempered by significant implementation challenges and, in some cases, negative impacts on businesses, particularly in the Federal Capital Territory (FCT).

As the Director General of the ACCI, I provide a comprehensive evaluation of these outcomes, emphasizing successes, challenges, and a strategic roadmap for sustainable progress.

Mixed Results: Achievements and Challenges

The Tinubu administration’s policies have been driven by a commitment to fiscal discipline, market liberalization, and infrastructure development. While these reforms have delivered measurable gains, their execution has often been hampered by inadequate planning, coordination gaps, and unintended consequences, particularly for small and medium enterprises (SMEs) in the Federal Capital Territory (FCT), Abuja.

Fuel Subsidy Removal: The removal of the fuel subsidy on May 29, 2023, was aimed at eliminating a huge annual fiscal drain reportedly running into billions of US dollars, redirecting savings to infrastructure and social programs. This bold reform achieved an immediate impact by significantly increasing Federation Account Allocation Committee (FAAC) disbursements between May 2023 and April 2024, and reducing the budget deficit from 5.7% of GDP in 2022 to 4.5% in 2023.

Implementation Challenge: The abrupt implementation, without a phased transition or robust palliatives, triggered an increase in petrol prices of about 152%, driving a steep rise in headline inflation and food inflation. This increased operational costs for SMEs, which rely on petrol-powered generators owing to low grid supply. This led to reduced profit margins and some temporary closures by SMEs in Q3 2024. The delayed and poorly targeted N5 billion per state palliative failed to mitigate these impacts, straining businesses and consumers alike.

Foreign Exchange Reforms: Unifying exchange rates and naira floatation in June 2023 sought to eliminate arbitrage and attract investment. It was reported that this initiative cleared a significant forex backlog and delivered a Balance of Payments surplus in 2024, with an appreciable increase in non-oil exports and gas exports. Foreign portfolio investment inflows improved in Q1 2024, and a World Bank injection of funds bolstered confidence. Exporters in agro-processing and solid minerals benefited, with a good number of businesses shifting to local inputs, fostering backward integration.

Implementation Challenge: The naira’s depreciation to N1,035/$ by December 2023 raised import costs and dropped manufacturing capacity utilization. SMEs, lacking access to forex hedging tools, reported a 20% decline in output. The Central Bank of Nigeria’s (CBN) limited intervention capacity was insufficient to curb volatility, with 30% of our members citing forex uncertainty as a major constraint. These challenges undermined the reform’s benefits for import-dependent businesses in the FCT.

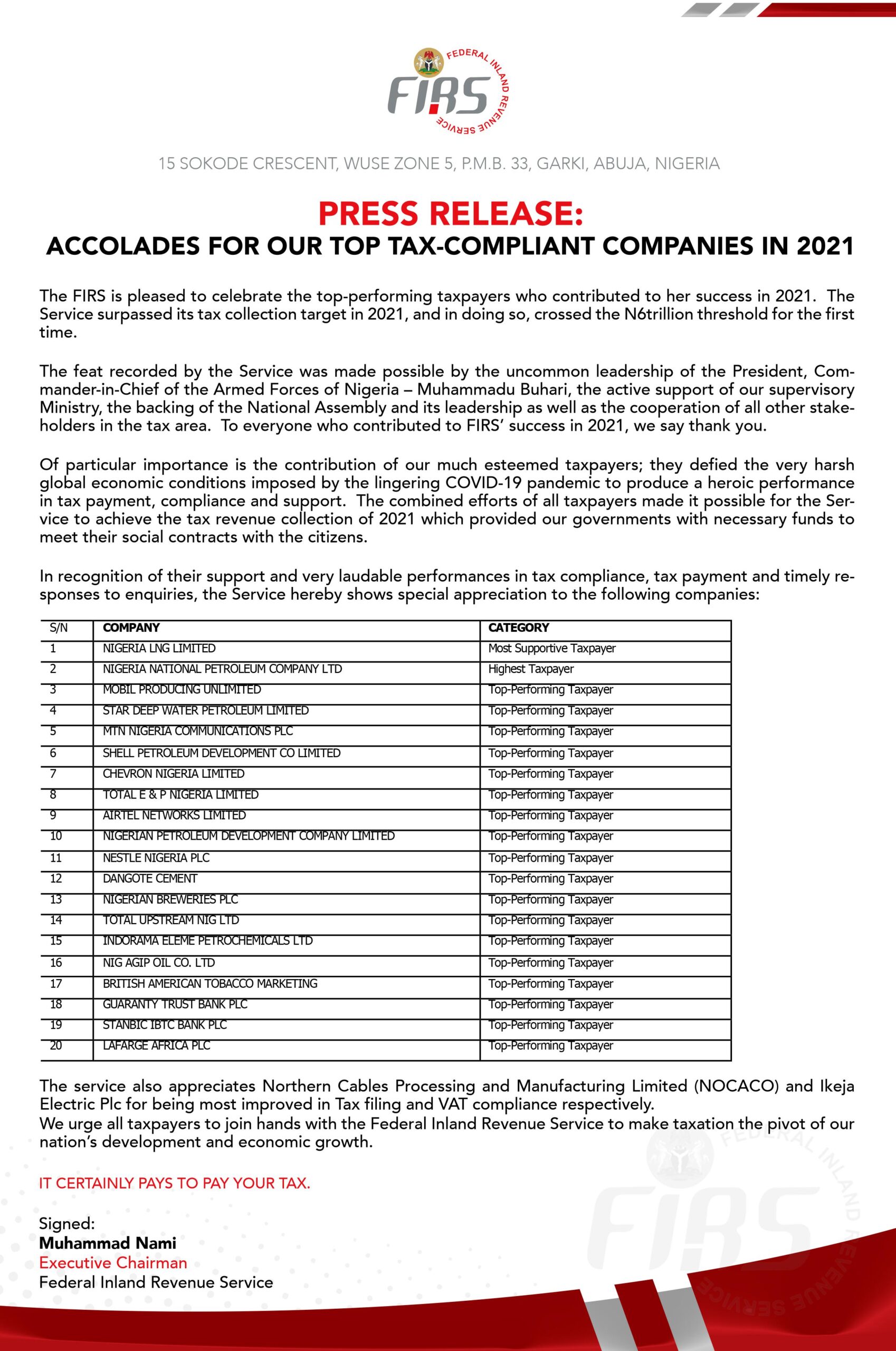

3. Tax and Fiscal Reforms: Executive orders in July 2023 deferred burdensome provisions of the Finance Act 2023, responding to ACCI’s advocacy. Tax revenue was reported to have grown by 30% in 2023, with a reported increase in Nigeria Customs Service revenue at N1.751 trillion in Q1 2025. Pioneer status incentives for renewable energy and agribusiness attracted increased private investment and consistent debt repayments stabilized reserves, supporting business confidence.

Implementation Challenge: Duplicative taxes persisted, with compliance costs at 3% of SME turnover, according to ACCI surveys. Slow VAT refund processes (6–12 months) constrained cash flow for exporters, limiting trade potential. Arbitrary enforcement by state agencies eroded trust, with 40% of our members reporting regulatory harassment in 2024. These frictions offset the benefits of revenue growth for many businesses.

4. Infrastructure Development: The administration’s N2.7 trillion investments in the 2024 budget for roads, rail, and digital infrastructure enhanced the FCT business ecosystem. Completed projects, such as the Abuja-Kaduna expressway, reduced logistics costs and travel times.

Implementation Challenge: Only about 30% of 74 road projects were completed by Q1 2025, limiting economic multipliers. Grid supply remained at 3,500 MW, forcing about 60% of businesses to spend 30% of their operating expenses on generators. These gaps constrained manufacturing and service sectors in the FCT, with 35% of our members citing power shortages as their top challenge in 2024. ACCI surveys in Q1 2025 indicated that infrastructure deficits are the key challenges for the IDU Industrial layout in the FCT – issues range from poor road infrastructure, low power supply, and inadequate broadband coverage.

5. Monetary Policy and Financial Inclusion: The CBN’s monetary tightening, with the Monetary Policy Rate at 27.5%, reduced non-performing loans to 4% in 2024, ensuring banking sector stability. The BOI’s N200 billion intervention fund aims to support over 2,000 businesses and create 3,000 jobs. An appreciable increase in digital transactions boosted the e-commerce and retail sectors.

Implementation Challenges: High lending rates (above 30%) limited private sector credit growth in 2024, with SMEs facing a 50% loan rejection rate. Supply-side inflation drivers (food, energy) limited the efficacy of monetary tightening, with inflation at 33.69% in April 2024. These constraints restricted SME expansion, a critical driver of the FCT’s economy.

6. Security and Business Climate: Defense spending of N2.2 trillion in 2024 and community policing somewhat restored a portion of the previously disrupted agricultural supply chains, benefiting the agro-allied industries. Security gains attracted some new FDI commitments in 2024.

Implementation Challenge: Rural insecurity has continued to disrupt agricultural output, affecting Abuja’s food processing sector, and Nigeria’s poor ranking on the Corruption Perception Index has deterred FDI.

ACCI’s Strategic Role

The President of ACCI, Chief Emeka Obegolu, SAN, PhD, has strengthened its advocacy initiative driven by the ACCI National Policy and Advocacy Centre (NPAC) through strategic partnerships and collaborations with the EU, ICR, TFO Canada, UNDP, NEPC, NIPC, SMEDAN, AEA, the Federal Ministries of Industry, Trade and Investments, Budget and Economic Planning, Livestock Development, as well as the National Data Protection Commission and the Actors Guild of Nigeria, which have advanced data protection and creative industry growth. Our focus on SME insurance and gender-inclusive policies underscores our commitment to inclusive development.

The Way Forward: Strategic Recommendations

To address implementation challenges and mitigate negative impacts, the ACCI proposes:

Macroeconomic Stabilization:

Coordinate fiscal and monetary policies to reduce inflation to 20% by Q4 2026, using agricultural subsidies and gas-to-power investments.

Adopt a managed float with a 10% naira volatility band, prioritizing forex for productive sectors.

SME and Industrial Support:

Scale up the BOI’s SME fund, targeting increased numbers of FCT businesses.

Introduce an improved credit guarantee scheme to de-risk SME lending.

Infrastructure Acceleration:

Complete 50% of road projects by Q2 2026, using real-time monitoring dashboards.

Launch a robust gas-to-power initiative to achieve 7,000 MW by 2027, cutting energy costs by 20%.

Digital Transformation:

Expand the 3MTT program to train more women and young people in AI and blockchain.

Achieve 60% broadband penetration (especially at the IDU Industrial layout of the FCT and other manufacturing, trade and commerce clusters in the Country) by 2026 via public-private partnerships.

Security and Governance:

Deploy technology and AI-driven surveillance in 70% of economic corridors by 2026, reducing disruptions by 30%.

Automate 80% of tax and procurement processes to improve Nigeria’s Corruption Perception Index ranking by 2027.

Stakeholder Engagement:

Establish a quarterly public-private dialogue platform, led by the ACCI.

Conduct regular reform impact assessments.

Conclusion: A Call for Collaboration

The President Tinubu administration’s two years have delivered a mixed bag of results, with well-intentioned reforms driving fiscal gains, trade growth, and infrastructure advancements, but implementation challenges and negative impacts like inflation and forex volatility have strained businesses.

The administration inherited a very bad economy at inception in May 2023. It has surmounted the initial mountainous difficulties facing the nation, but there are still mountains to be scaled to consolidate reforms.

Abuja remains a vibrant hub, and the ACCI is committed to partnering with the government to refine policies, support SMEs, and drive inclusive growth. By implementing these recommendations, Nigeria can maximize the benefits of these reforms and be re-positioned as a global economic powerhouse.

Jideani is the Director General, Abuja Chamber of Commerce and Industry.

Comments are closed, but trackbacks and pingbacks are open.